is pre k tax deductible

Can pre k tax deductible. That doesnt necessarily mean you cant still get some money.

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS.

. Bookkeeping Let a professional handle your small business books. What school expenses are tax deductible. The credit is limited to a maximum of 3000 per child and 6000 for two or more children in preschool.

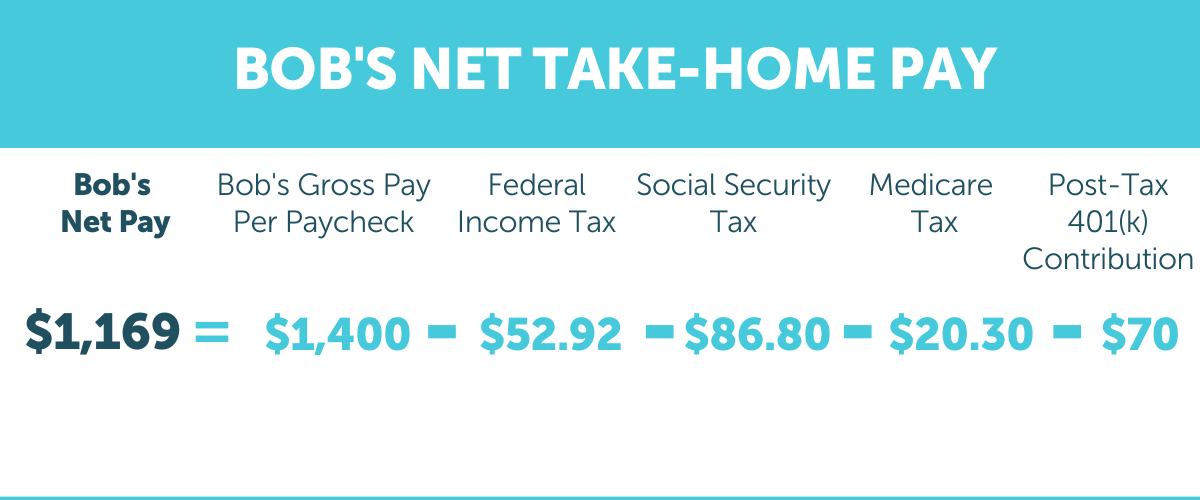

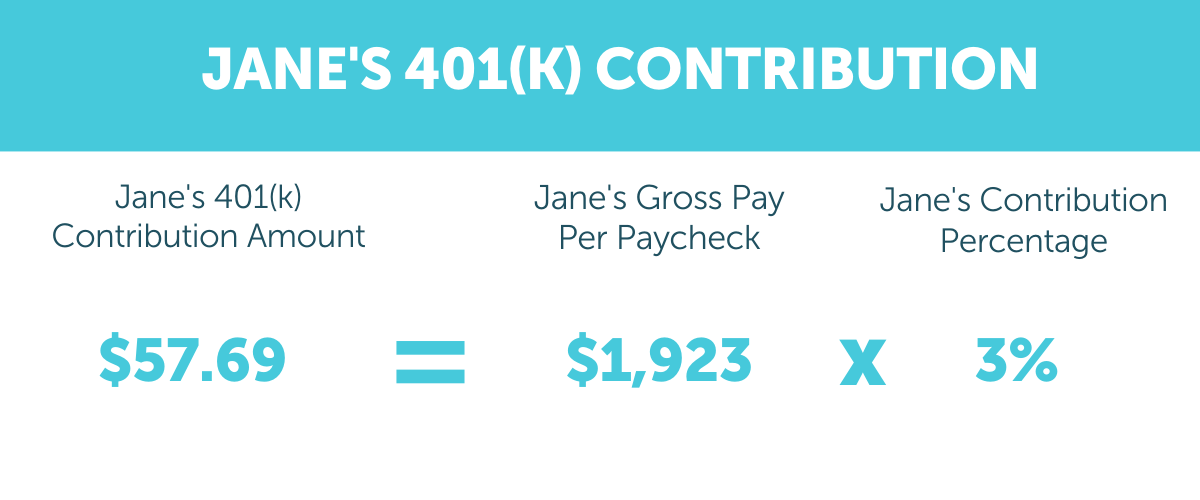

Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses. If youre wondering whether preschool costs are tax deductible. First subtract the 50 pre-tax withholding from the employees gross.

Small business tax prep File yourself or with a small business certified tax professional. The deduction requires a physicians. Is pre k tax deductible sunday july 10 2022 edit.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. They may be but the IRS has set out strict requirements. If you have received childcare compensation from your employer you should deduct that from your total expenses in computing the credit as directed by Form 2441.

The care provider cant be your spouse the parent of your child someone you or your spouse could claim as a dependent on your tax returns or another one o See more. Preschool and pre-kindergarten programs may qualify for a tax credit for children who are too young to attend school. Now we have got the complete detailed explanation and answer for.

Qualified expenses include required tuition and fees books supplies and equipment including computer or peripheral equipment. Is preschool tuition tax-deductible. In addition the credit is limited by the amount of your income and to qualify you.

Since at least if one or both. This is a question our experts keep getting from time to time. First and foremost you should know that preschool tuition isnt technically tax deductible.

These programs double as a child care service making the cost. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. This tax benefit is available for nursery and other pre. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit.

475 18 votes The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than. Additionally you might consider. Can pre k tax deductible.

Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense. Preschool fees are generally not tax-deductible from a parents taxes. If your child is attending a private K-12 school because they have special education needs you may be able to get a tax break on the tuition.

Ordinarily a taxpayer can only confer 16000 a year for.

Pre Tax Vs Post Tax Deductions What Employers Should Know

Can I Claim Private Pre K As A Tax Deduction

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Pre Tax Vs Post Tax Deductions What S The Difference

Is Private School Tuition Tax Deductible

Is Preschool Tuition Tax Deductible In 2021 Here S What To Know

Is Private School Tuition Tax Deductible

What Are Pre Tax Deductions Definition List Example

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

Your 2021 Child Care Costs Could Mean 8 000 Tax Credit

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Understanding Pre Vs Post Tax Benefits

Transitional Kindergarten In California Without State Help Calmatters

Is A 401 K Match Contribution Tax Deductible Human Interest

5 Tips For Mission Trip Tax Deductions Ramsay And Associatesramsay And Associates

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll